A new report by the World Bank, World Wildlife Fund (WWF), and the Gordon and Betty Moore Foundation projects an unprecedented future for aquaculture, positioning it as one of the most promising opportunities to build a more sustainable food system over the next 25 years. Far from being a simple alternative, the sector is emerging as the largest investment opportunity in sustainable food, with a potential that could reach 1.5 trillion dollars and generate up to 22 million new jobs by 2050.

The report, titled “Harnessing the Waters: A Trillion Dollar Investment Opportunity in Sustainable Aquaculture,” analyzes in depth the trends and, above all, the enormous opportunities that aquaculture offers. It is designed for financial institutions, governments, philanthropies, and private investors looking to expand their portfolios in the blue economy, a sector whose production is expected to grow by 14% by 2032.

- 1 Why is aquaculture the protein source of the future?

- 2 Projections for growth, investment, and employment to 2050

- 3 The trillion-dollar investment opportunity

- 4 Lessons from the “aquaculture giants”: the case studies

- 5 New frontiers: Where are the future aquaculture powerhouses?

- 6 The crucial role of a diverse ecosystem of investors

- 7 Conclusion: more than a good business, a sustainable necessity

- 8 Entradas relacionadas:

Why is aquaculture the protein source of the future?

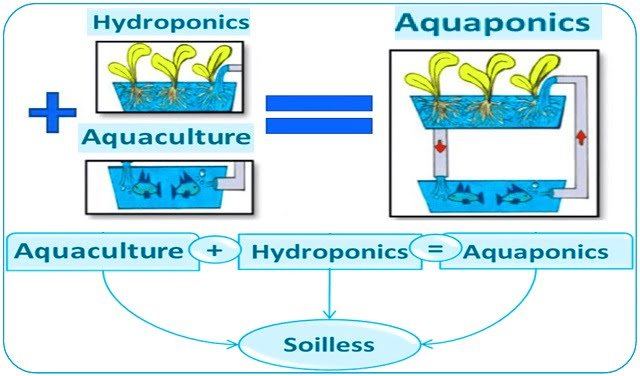

With the growing global demand for seafood and the overexploitation of wild fisheries, aquaculture has become essential for food security and economic growth. Its consolidation as a pillar of the food system is a fact: it is now responsible for nearly 60% of the world’s seafood production.

The report highlights two pillars of its sustainability:

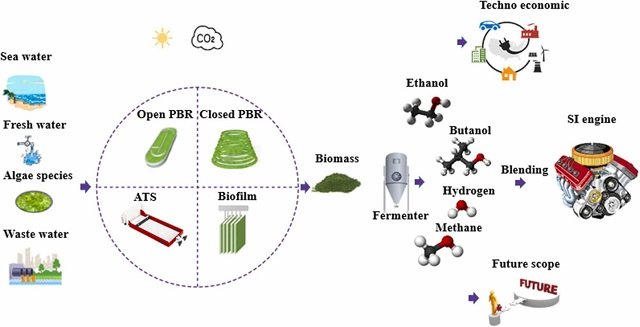

- The smallest carbon footprint: Aquaculture has the lowest greenhouse gas (GHG) emissions among all animal protein production sectors.

- Innovation in feed: The dependence on fishmeal and fish oil has drastically decreased, thanks to the incorporation of plant-based alternatives and new protein sources.

“Aquaculture is among the most sustainable ways to produce animal protein and will be essential in feeding the world’s growing population,” stated Sergio Nates, Senior Director for Aquaculture at WWF. “As the sector continues to expand, it holds immense potential to generate a positive social impact globally. It is crucial that we guide this growth through sustainable and responsible production practices.”

Projections for growth, investment, and employment to 2050

The document presents two scenarios that directly link investment with production and job creation:

- Business as Usual (BAU) scenario: With investments of US$0.5 trillion, production is projected to grow at a rate of 1.9% to reach 159 million metric tons by 2050. This could generate between 8 and 14 million new jobs.

- Upside scenario: With a more ambitious investment of US$1.5 trillion in technology and efficiency, production could soar to 255 million metric tons, almost 100 million more than in the business-as-usual case. This boost would create between 13 and 22 million jobs.

This growth is not just a figure, but a direct response to the growing global demand for protein, driven by population growth and the expansion of the middle class in emerging markets.

The trillion-dollar investment opportunity

To materialize this growth, an unprecedented mobilization of capital will be needed. The report estimates that the financing required between 2025 and 2050 will range from US$0.5 trillion for the base case to US$1.5 trillion for the upside scenario.

This investment is not limited to farms. The growth of aquaculture will generate a multiplier effect in auxiliary industries, especially in feed production. To meet the projected demand, the production of alternative ingredients (algae, insect meal, and other non-marine sources) will need to double in the BAU scenario and triple in the upside scenario.

Stay Always Informed

Join our communities to instantly receive the most important news, reports, and analysis from the aquaculture industry.

Lessons from the “aquaculture giants”: the case studies

The report analyzes seven mature industries to extract valuable lessons: shrimp from Ecuador, carp from China, salmon from Chile, prawn from Thailand, tilapia from Egypt, pangasius from Vietnam, and black tiger shrimp from Bangladesh.

From these cases, it is clear that market leaders share common characteristics:

- Focused national strategies and public sector support.

- Public-private investment in R&D to improve efficiency and yields.

- Industrial collaboration to develop export markets.

Ecuador, for example, has managed to maintain its global competitiveness in shrimp not through high intensity, but through improvements in efficiency, achieving feed conversion ratios as low as 1.4. Chile, for its part, transformed the ISA virus crisis into an opportunity to implement stricter environmental and biosecurity regulations, strengthening its industry in the long term.

New frontiers: Where are the future aquaculture powerhouses?

While Asia dominates production today (85% of the total), the future of growth lies in emerging markets. Under the upside scenario, Asia’s share could drop to 70%, while 34% of the new production capacity would come from Latin America, sub-Saharan Africa, Mexico, and Turkey.

Countries like Brazil, Mexico, Colombia, Nigeria, and Turkey are emerging as future leaders, thanks to their physical capacity for new production, large domestic markets, and potential to attract foreign investment and technology transfer.

The crucial role of a diverse ecosystem of investors

To reach its full potential, the sector now requires innovative financing to boost its expansion, especially in emerging markets. The report concludes that the sustainable growth of aquaculture requires a significant transition from small-scale production to more intensive and efficient production.

“To realize aquaculture’s full potential, we must shift toward practices that are not only productive, but also environmentally responsible, socially inclusive, and economically viable,” stated Genevieve Connors, acting Global Director of the Environment Department at the World Bank. “This is a call to action—to deepen collaboration, to invest boldly in new aquaculture technologies, and to foster stronger alignment between public and private sectors.”

This investment ecosystem must include:

- Public finance and multilateral banks: Creating a conducive environment and reducing risk for private capital.

- Philanthropic and impact investors: Financing innovation in early stages and supporting small producers.

- Private investors: Having multiple entry points, from consolidated companies to high-growth markets like India, Brazil, or Mexico.

Conclusion: more than a good business, a sustainable necessity

The “Harnessing the Waters” report is not just a call for investment, but a confirmation of reality: aquaculture is no longer the future, it is the present of aquatic protein production.

The trillion-dollar opportunity goes hand in hand with the possibility of generating a massive social impact and consolidating the sector as one of the most efficient and low-climate-impact ways to feed the planet. For all actors in the sector, the message is clear: the time to bet on a sustainable, technological, and profitable aquaculture is now.

Reference (open access)

World Bank. 2025. Harnessing the Waters – Volume I (English). Washington, D.C. : World Bank Group. http://documents.worldbank.org/curated/en/099062325120031041

Editor at the digital magazine AquaHoy. He holds a degree in Aquaculture Biology from the National University of Santa (UNS) and a Master’s degree in Science and Innovation Management from the Polytechnic University of Valencia, with postgraduate diplomas in Business Innovation and Innovation Management. He possesses extensive experience in the aquaculture and fisheries sector, having led the Fisheries Innovation Unit of the National Program for Innovation in Fisheries and Aquaculture (PNIPA). He has served as a senior consultant in technology watch, an innovation project formulator and advisor, and a lecturer at UNS. He is a member of the Peruvian College of Biologists and was recognized by the World Aquaculture Society (WAS) in 2016 for his contribution to aquaculture.