The FAO’s (Food and Agriculture Organization of the United Nations) 2023 Yearbook of Fishery and Aquaculture Statistics is now available, offering the most current and comprehensive global overview of the sector, with data up to 2023 (and up to 2021 for consumption balances). This report, an indispensable reference for the industry, reveals key trends and record-breaking figures that are charting the course for aquatic food production.

- 1 Key findings from the FAO 2023 Yearbook:

- 2 Global production: A new record driven by aquaculture

- 3 Aquaculture consolidates its leadership

- 4 Capture fisheries: Stability with variations

- 5 International trade: A dynamic market

- 6 Consumption: More aquatic products on the table

- 7 Employment in the sector: Aquaculture drives growth

- 8 Conclusion

- 9 Entradas relacionadas:

Key findings from the FAO 2023 Yearbook:

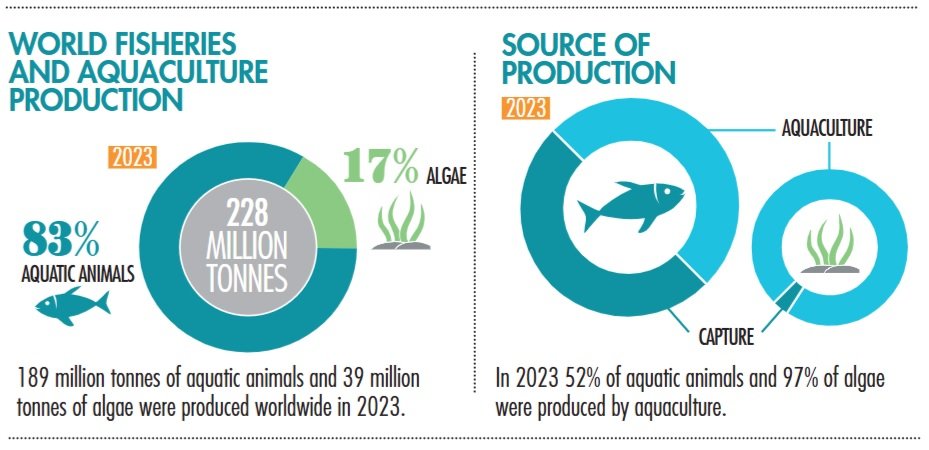

- Record total production: An all-time high of nearly 228 million tonnes was reached in 2023, combining aquatic animals and algae.

- Aquaculture leadership: For the second consecutive year, aquaculture surpassed capture fisheries as the primary source of aquatic animals, contributing 52% of the total (98.5 million tonnes). Including algae, aquaculture accounts for 60% of total production.

- Asian dominance: Asia remains the sector’s powerhouse, responsible for 72% of the global production of aquatic animals.

- Stable per capita consumption: Apparent per capita consumption of aquatic foods stood at 20.5 kg in 2021, more than double the rate in the 1960s.

Global production: A new record driven by aquaculture

In 2023, the combined global production of fisheries and aquaculture reached a historic milestone: nearly 228 million tonnes. Of this total, 189 million tonnes consisted of aquatic animals (a 2.1% increase from 2022), and 39 million tonnes were algae. The estimated first-sale value of aquatic animals reached USD 501 billion, of which USD 347 billion was generated by aquaculture.

The primary driver of this growth was undoubtedly aquaculture, whose production of aquatic animals increased by 4.2% compared to the figures reported in the SOFIA Report for 2022. Conversely, capture fisheries experienced a slight decrease of 0.2%, primarily attributed to fluctuations in catches of pelagic species such as anchoveta.

Asia reaffirms its dominant position, contributing 72% of the total production of aquatic animals. It is followed by the Americas (11%), Europe (9%), Africa (7%), and Oceania (1%).

Aquaculture consolidates its leadership

Confirming the trend observed since 2022, aquaculture has established itself as the main source of aquatic animals globally. In 2023, it produced 98.5 million tonnes, surpassing the 90.4 million tonnes from capture fisheries. This milestone reflects the sustained growth of aquaculture, whose contribution to total production has risen from 4% in the 1950s to the current 52.2%.

Aquaculture production of aquatic animals is geographically concentrated: China (56%), India (11.5%), and Indonesia (5.7%) collectively accounted for nearly 79% of the world’s total in 2023. Asia, as a whole, contributed almost 89%.

Inland aquaculture (freshwater) remains the most significant in volume for aquatic animals, with 61.7 million tonnes (63% of the aquaculture total), compared to 36.8 million tonnes from marine and brackishwater aquaculture. Species such as carps, tilapias, and catfishes dominate in freshwater, while oysters, Whiteleg shrimp (Litopenaeus vannamei), Atlantic salmon, and Milkfish are key in marine/brackishwater environments.

Regarding algae, aquaculture is overwhelmingly dominant, generating 37.6 million tonnes (97% of the total algae), mainly in China (61.3%) and Indonesia (25.9%).

The total farm-gate value of aquaculture (animals and algae) reached USD 365.7 billion in 2023.

Stay Always Informed

Join our communities to instantly receive the most important news, reports, and analysis from the aquaculture industry.

Capture fisheries: Stability with variations

Global capture fisheries production remained relatively stable at 90.4 million tonnes of aquatic animals in 2023, a slight decrease of 0.2% from the previous year. The long-term trend continues to fluctuate between 86 and 96 million tonnes annually since the mid-1990s.

Marine fisheries contributed 78.3 million tonnes (1.0% less than in 2022), while inland fisheries grew by 5.5%, reaching 12.0 million tonnes.

The main capture producers in 2023 were China (14.6%), Indonesia (8.6%), and India (6.8%), jointly accounting for nearly 30% of the world total. This indicates less geographical concentration compared to aquaculture. They were followed by the Russian Federation, the USA, Peru, and Viet Nam.

By species, Alaska pollock (Gadus chalcogrammus) was the most captured (3.5 million tonnes), followed by Skipjack tuna (Katsuwonus pelamis) (3.0 million tonnes) and Anchoveta (Engraulis ringens) (2.4 million tonnes), despite relatively low catches for the latter in 2023. Herrings, sardines, and anchovies as a group represented over 17% of the total catch.

International trade: A dynamic market

International trade remains vital for the sector. In 2023, an estimated 35% of the total production from fisheries and aquaculture was traded internationally.

The value of global exports of aquatic animal products reached USD 182 billion, a 3.9% decrease from the 2022 record. Europe was the main exporter by value (38%), followed by Asia (34%) and the Americas (21%). By country, China led exports (11%), followed by Norway, Viet Nam, and Ecuador.

Regarding imports, Europe was also the main market (41%), followed by Asia (35%) and the Americas (20%). The largest importers were the United States, China, Japan, and Spain. High-income countries accounted for 74% of the total import value.

The trade in algae, though smaller in volume, reached USD 1.5 billion in exports in 2023.

Consumption: More aquatic products on the table

The most recent data for apparent consumption corresponds to 2021. That year, global per capita consumption of aquatic foods (excluding algae) stood at 20.5 kg, maintaining the long-term upward trend (it was 9.9 kg in the 1960s). Preliminary estimates suggest a slight increase to 20.7 kg in 2022 and 21 kg in 2023.

Asia had the highest per capita consumption (24.7 kg), followed by Europe (21.9 kg), Oceania (21.6 kg), the Americas (15.3 kg), and Africa (9.2 kg).

The composition of consumption has varied: in 2021, fish represented 73% of aquatic animal consumption, while shellfish (crustaceans, mollusks) accounted for 26%. Freshwater and diadromous fish were the most consumed group (41% of the per capita total).

Furthermore, the yearbook highlights that thanks to the boom in aquaculture, an estimated 58% of the aquatic foods available for human consumption in 2023 came from farms. Nutritionally, aquatic foods provided about 15% of global animal protein intake in 2021.

Employment in the sector: Aquaculture drives growth

The primary fisheries and aquaculture sector employed nearly 63.2 million people worldwide in 2023, representing an increase of 1.4 million from 2022. The general trend is upward, driven mainly by strong employment growth in aquaculture, which added 1.1 million workers (a 5% increase). Marine capture fisheries also saw an increase of nearly 0.6 million people (3.5%), while employment in inland fisheries experienced a slight decline of 1%. Asia remains the main employment hub, concentrating 95% of aquaculture workers and 77% of capture fishers.

Employment breakdown in fisheries and aquaculture (2023)

- Global total: An estimated 63.2 million people worked in the primary sector in 2023.

- Capture fisheries: Over 34 million people were engaged in this activity.

- Marine fisheries: Experienced an increase of nearly 0.6 million people (+3.5%) compared to 2022.

- Inland fisheries: Decreased by 0.2 million people (-1%).

- Aquaculture: Employed 23 million people.

- Growth: Aquaculture was the main driver of the total employment increase, adding 1.1 million workers (+5%) compared to 2022, primarily in Asia.

- Unspecified workers: For 6 million people, it was not possible to determine if they worked in fisheries or aquaculture.

Geographical and gender distribution

- Concentration in Asia: This continent dominates employment, hosting 77% of capture fishers and 95% of aquaculture workers in 2023. Africa follows in importance for capture fisheries (15%) and aquaculture (3%).

- Female participation: Where data allowed for sex disaggregation (64% of the total), it is estimated that women represented nearly a quarter (24-27%) of the workforce.

- Capture fisheries: Women accounted for 24% (with data available for 77% of the sector). This proportion was notably high in the Americas (39%) and low in Europe (4%).

- Aquaculture: Women represented 27% (with data available for 60% of the sector), driven by Asia. Female participation was lower in the Americas (13%), Oceania (12%), and Africa (15%).

Employment status and processing

- Time dedication: Where the time-use category was reported (56% in fisheries, ~40% not reported in aquaculture), the majority worked full-time or part-time (82-83%), while a minority worked occasionally (17-18%).

- Employment in processing: Although data coverage is still limited (59 countries in 2023), 2.4 million people were reported working in aquatic product processing.

Editor’s Note: It is important to note that the FAO is continuously working to improve the quality and coverage of this data, which may lead to revisions in future editions.

Conclusion

The 2023 Yearbook of Fishery and Aquaculture Statistics confirms the sector’s sustained growth trend, reaching a record global production of nearly 228 million tonnes, combining aquatic animals and algae. Aquaculture is consolidated as the main driver of this growth, surpassing capture fisheries in aquatic animal production for the second consecutive year and now accounting for 52% of this total. Meanwhile, capture fisheries production remains relatively stable, albeit with slight annual variations. Asia continues to be, by far, the dominant region in both aquaculture and capture fisheries.

This data underscores the growing importance of aquaculture in meeting global demand for aquatic foods and its fundamental role in food security, nutrition, and the livelihoods of millions. The steady increase in per capita consumption, which exceeded 20.5 kg in 2021, reflects this reliance. While capture fisheries remain essential, the dynamism and expansion of aquaculture are charting the future of aquatic product production globally, as evidenced by the latest figures published by the FAO.

Reference (open access)

FAO. 2025. Fishery and Aquaculture Statistics – Yearbook 2023. FAO Yearbook of Fishery and Aquaculture Statistics. Rome. 240 p. https://doi.org/10.4060/cd6788en

Editor at the digital magazine AquaHoy. He holds a degree in Aquaculture Biology from the National University of Santa (UNS) and a Master’s degree in Science and Innovation Management from the Polytechnic University of Valencia, with postgraduate diplomas in Business Innovation and Innovation Management. He possesses extensive experience in the aquaculture and fisheries sector, having led the Fisheries Innovation Unit of the National Program for Innovation in Fisheries and Aquaculture (PNIPA). He has served as a senior consultant in technology watch, an innovation project formulator and advisor, and a lecturer at UNS. He is a member of the Peruvian College of Biologists and was recognized by the World Aquaculture Society (WAS) in 2016 for his contribution to aquaculture.