An exhaustive participatory study led by Embrapa Fisheries and Aquaculture provides a strategic roadmap for the future of the Brazilian aquaculture sector. Drawing on the insights of experts from across the entire production chain, the report identifies the key drivers of change—from sustainability and technology to market consolidation and regulatory challenges—that will define the next decade.

Globally, aquaculture has proven to be a fundamental pillar of food security, with an annual growth rate of 7.5% since the 1970s, in stark contrast to the stagnation of capture fisheries. In line with this global trend, Brazil has established itself as a relevant player, ranking eighth in the world for inland aquaculture production. This growth, however, necessitates careful planning and adaptation to an increasingly complex and demanding environment.

A forward-looking approach: How were these trends identified?

To develop a reliable forecast, Embrapa researchers adopted a prospective and collaborative methodology. Initially, they interviewed six key industry stakeholders to compile a preliminary list of trends. This list was then converted into an online survey, which was completed by 89 specialists from universities, research institutions, public entities, private companies, and sector organizations between June and November 2023.

Finally, the findings were discussed in a participatory workshop during the “Aquishow Brasil” event in May 2024. This enriched the analysis with practical challenges and opportunities identified by the sector’s own key players.

The top 5 trends shaping Brazilian aquaculture

The study ranked the trends based on their likelihood of occurrence. The five deemed most probable and their impact on the sector are detailed below.

A shift towards more sustainable production

Ranked as the most critical trend, the implementation of more sustainable systems is no longer an option but a necessity. Sustainability is defined here as a practice that is environmentally and socially responsible, economically viable, and minimizes negative impacts. Experts highlight several key strategies:

- Water efficiency: Water scarcity and stricter controls on effluents are driving the adoption of technologies like Recirculating Aquaculture Systems (RAS).

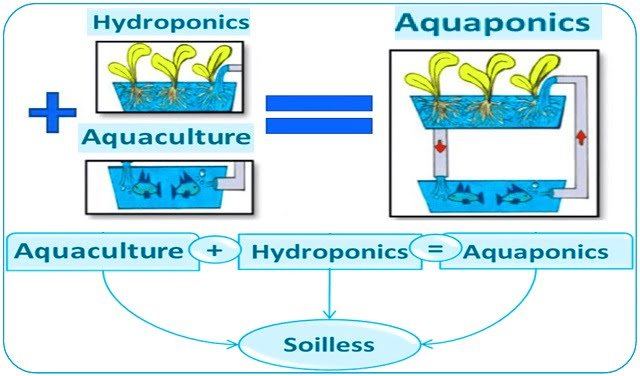

- Circular economy: The integration of aquaculture with agriculture (aquaponics) or the use of effluents for crop irrigation are practical examples.

- Integrated Multi-Trophic Aquaculture (IMTA): The joint cultivation of species from different trophic levels, such as fish with mollusks and algae, allows for nutrient recycling and production diversification.

- Climate adaptation: Planning must include measuring the carbon footprint and developing lines more resistant to high temperatures.

Increased demand for processed products

The second most significant trend responds to a shift in consumer behavior towards convenience, practicality, and food safety. This translates into greater demand for products such as fillets, special cuts, and ready-to-eat meals. The tilapia value chain is the clearest example of this phenomenon, where the fillet has been crucial in popularizing its consumption in households. This movement not only boosts the processing industry but also opens doors for exporting higher-value-added products.

The commoditization of tilapia

The transformation of tilapia into a commodity—a standardized product produced on a large scale for mass consumption—is a consolidated trend. This process is supported by:

- Vertical integration: Large companies and cooperatives control multiple stages, from fry and feed production to processing and marketing.

- Export growth: Foreign sales, primarily of fillets to the United States, have grown consistently.

- Standardization: A uniform product is offered (white meat, mild flavor, regular cuts) that has broad market acceptance.

Simplification of environmental licensing

A long-standing barrier to the sector’s formal growth is the bureaucracy and high cost of environmental licensing, which pushes many producers, especially smaller ones, into informality. Experts stress the urgent need to simplify these processes to encourage legalization and operation under proper environmental standards. The challenge is to streamline procedures without sacrificing environmental protection, establishing clear criteria and effective monitoring.

Stay Always Informed

Join our communities to instantly receive the most important news, reports, and analysis from the aquaculture industry.

Health risks and the need for biosecurity

As production intensifies, so do health risks. The low adoption of biosecurity measures can lead to the spread of diseases, causing enormous economic losses and environmental impacts. To mitigate this risk, it is essential to implement actions such as:

- Access control and quarantine for juvenile fish.

- Constant monitoring of animal health and water quality.

- Sanitation of facilities and proper waste management.

- Mandatory reporting of any suspected disease to sanitary defense agencies.

Other significant changes on the horizon

Beyond the top five, the study highlights other relevant transformations:

- The future of small producers and native ish: Independent producers face difficulties competing with large, vertically integrated chains, meaning their future seems geared towards niche markets and local sales. This is linked to the trend of native fish producers migrating to tilapia farming, which offers more developed technological packages and lower costs. Preserving productive diversity with native species is a key challenge for the sector’s resilience.

- Aquaculture and the carbon credit market: Although still nascent in Brazil due to a lack of regulation, the integration of aquaculture into the carbon market represents a long-term opportunity. To achieve this, it is vital to develop inventories and emission measurement methodologies adapted to tropical conditions.

Conclusion: A sector in full transformation towards integral sustainability

The trends analyzed by Embrapa converge on a central idea: the future of Brazilian aquaculture depends on adopting more sustainable practices across its three pillars. Environmentally, resource efficiency and impact mitigation are non-negotiable. Socially, the sector has the potential to strengthen food security and generate quality employment. Economically, innovation, cost reduction, and market expansion will continue to be the engines that confirm aquaculture as a strategic pillar for Brazil’s development.

Reference (open access)

Ummus, M. E., Pedroza Filho, M. X., Kimpara, J. M., & Kato, H. C. de A. (2025). Tendências da Aquicultura no Brasil – um levantamento participativo (Documentos 58). Embrapa Pesca e Aquicultura. 54 p.

Editor at the digital magazine AquaHoy. He holds a degree in Aquaculture Biology from the National University of Santa (UNS) and a Master’s degree in Science and Innovation Management from the Polytechnic University of Valencia, with postgraduate diplomas in Business Innovation and Innovation Management. He possesses extensive experience in the aquaculture and fisheries sector, having led the Fisheries Innovation Unit of the National Program for Innovation in Fisheries and Aquaculture (PNIPA). He has served as a senior consultant in technology watch, an innovation project formulator and advisor, and a lecturer at UNS. He is a member of the Peruvian College of Biologists and was recognized by the World Aquaculture Society (WAS) in 2016 for his contribution to aquaculture.