Western Sahara Resource Watch (WSRW) has through several years covered how illegally caught fish from occupied Western Sahara is transformed into fishmeal and fishoil, and exported to serve the aquaculture industry in Europe and Turkey.

Today, a new report was issued that addresses the lack of sustainability in the aquaculture industry.

The report is a cooperation between the NGOs Changing Markets Foundation, Feedback, Coalition for Fair Fisheries Arrangements and Western Sahara Resource Watch. The report “Investing in troubled waters: the material risks of fish mortality and the use of wild-caught fish in feed for the aquaculture sector” warns that profits are at risk if investors do not rapidly address ESG issues in the seafood industry.

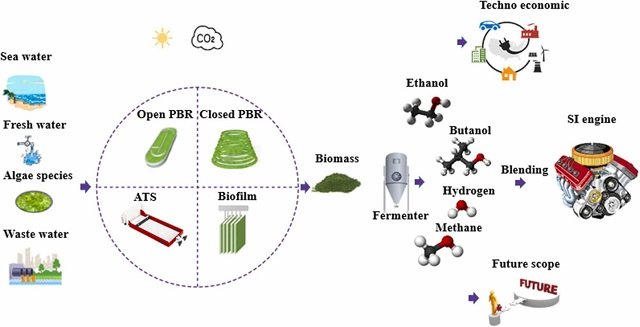

The report does not in directly address the fisheries in occupied Western Sahara, but points to a general concern that is particularly crucial in the sourcing of fishmeal and fishoil from the occupied territory: the lack of transparency in the industry’s supply chain and the use of wild fish for aquaculture.

The lack of transparency from the seafood industry means that it is not possible to know which seafood companies are producing fish based on controversial fishmeal and fishoil exported from occupied Western Sahara to countries such as Turkey, Netherlands, Germany and France.

“The diversion of small pelagic fish from human consumption towards fish feed, undermines food security in the whole West African region. It is impossible to know whether farmed salmon sold in the EU has been fed with fish coming from West Africa, or even if the fishmeal and fish oil has been sourced legally”, Béatrice Gorez, Coordinator, Coalition for Fair Fisheries Arrangements, commented.

The report recommends investors to demand a full disclosure of the supply chains, as well as requiring the industry to reduce he mortality rates on fish farms, adopt good fish welfare standards and elimiate the use of wild-caught fish in fed for aquaculture by 2025.

The value of the global aquaculture market is projected to reach US$376 billion by 2025. Soaring consumer demand for seafood, coupled with the depletion of wild-fish stocks from overfishing, is often perceived as an attractive target for investment. However, the analysis suggests issues such as fish mortality and wild-caught fish for feed present significant environmental, social, and animal welfare concerns that can affect returns and damage reputation, while also undermining the achievement of Sustainable Development Goals (SDGs).

Stay Always Informed

Join our communities to instantly receive the most important news, reports, and analysis from the aquaculture industry.

Alice Delemare Tangpuori, Campaign Manager at Changing Markets Foundation commented: “Investments in aquaculture are in troubled waters. Current unsustainable practices threaten to affect returns and damage reputation, as consumers come to realize the magnitude of fish dying in farms and also how these farms still use billions of wild-caught fish as feed, diverting valuable proteins from African and Latin American countries and damaging ocean ecosystems. Investors should be steering companies to address the risks by placing fish welfare front and centre and eliminating the use of wild-caught fish for feed in aquaculture supply chains.”

The aquaculture sector’s continued dependence on wild-caught fish for use in aquafeed represents a systemic and economic threat for companies, the report underines. Feed is the single largest input cost for fish farmers – between 50 and 70 percent of business expenditure – and higher prices are expected in the future.

Yet the analysis from Changing Markets Foundation found that no investors or financial institutions have criteria in place requiring a reduction or phase-out of the use of wild-caught fish as feed. 70 percent of investors and financial institutions fail to put in place criteria to ensure no Illegal, unreported and unregulated fishing or other compliance failures occur in their portfolio of investments and lending to the aquaculture sector.

The report also calls into question the use of green bonds in aquaculture. There is a huge appetite for debt issued to scale sustainable practices in seafood. However, none of the three companies that have issued a green bond in the aquaculture sector appear to be using the proceeds to take meaningful action on sustainability issues relating to wild-caught fish in feed.

The report concludes that, despite the aquaculture sector’s aspirations to improve global food security and relieve pressure on wild fish stocks, it is failing to deliver on this promise. Marketing images might tout farmed fish as a sustainable food with the ability to meet the world’s protein needs, but in reality, industrial aquaculture removes high quality protein and micronutrients from the food chain in one part of the world, usually countries with high levels of food insecurity, and transfers the nutrients to different, often more affluent, markets.

Rather than providing a solution to food security issues, the aquaculture sector is significantly undermining the achievement of SDG 2 – to end hunger and achieve food security – and SDG 14 – to conserve and sustainably use the oceans. Since many investors have committed to supporting the SDGs, they need to act to align their aquaculture investments with these commitments.

The analysis of the report was the outcome of in-depth questionnaires with 23 investors and financial institutions. The responses were ranked by those companies that “ignore the issue”, “acknowledge the issue but do not take sufficient measures to address it”, or “acknowledge the issue and takes some measures to address it”. Out of the 23 investors, DNB AM & DNB Liv, Rabobank, NNIP and Triodos IM scored the highest, yet no one company was found to sufficiently address all issues. Almost half of investors (48 percent) including BlackRock, Vanguard Group and APG Asset Management, scored a zero in the rankings.

Reference (open access):

Changing Markets Foundation. 2021. Investing in troubled waters. 31 p

Source: Western Sahara Resource Watch

Editor at the digital magazine AquaHoy. He holds a degree in Aquaculture Biology from the National University of Santa (UNS) and a Master’s degree in Science and Innovation Management from the Polytechnic University of Valencia, with postgraduate diplomas in Business Innovation and Innovation Management. He possesses extensive experience in the aquaculture and fisheries sector, having led the Fisheries Innovation Unit of the National Program for Innovation in Fisheries and Aquaculture (PNIPA). He has served as a senior consultant in technology watch, an innovation project formulator and advisor, and a lecturer at UNS. He is a member of the Peruvian College of Biologists and was recognized by the World Aquaculture Society (WAS) in 2016 for his contribution to aquaculture.